Here’s today’s ‘Just A Minute’ bringing you a 60 second summary of what’s happening in the financial markets:

WHAT WE’RE WATCHING TODAY

Dollar Gets Off To Slower Start In August

The U.S. dollar got off to a cooler start today after experiencing its biggest one-day fall in almost a month after a series of economic data led markets to push back expectations for the start of the Federal Reserve’s rate-tightening cycle. U.S. jobs growth slowed in July, the unemployment rate unexpectedly edged up and inflation was restrained, a mix of figures that may indicate the Fed will keep interest rates low for longer. The dollar index was last at 81.321 .DXY having retreated from a 10 1/2 month peak of 81.573. It had fallen 0.2 percent on Friday, a modest decline but still the biggest one-day fall in over three weeks. The index had rallied more than 2 percent in July as improving U.S. data convinced markets that an interest rate rise could be less than 12 months away. That allowed the euro to push back above $1.3400 EUR and off an eight month trough of $1.3366 plumbed last week. Against the yen, the dollar recoiled to 102.56 JPY, having stretched to a near four-month high of 103.15.

S&P 500 Sees Biggest Weekly Decline Since 2012

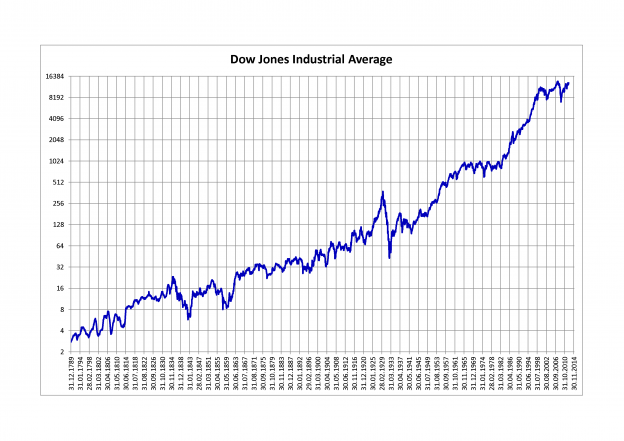

Data showing U.S. job growth eased off in July and the unemployment rate unexpectedly rose suggests that the Federal Reserve may keep interest rates low for a while. The jobs growth, which came in below economists’ forecasts, relieved some investors worried about how soon the Fed could increase interest rates after data on Thursday showed U.S. labour costs recorded their biggest gain in more than 5 1/2 years in the second quarter. Seven of the 10 S&P 500 sectors ended lower with S&P financials among sectors with the biggest losses. The Dow Jones industrial average fell 69.93 points to 16,493.37, the S&P 500 lost 5.52 points to 1,925.15 and the Nasdaq Composite dropped 17.13 points to 4,352.64. For the week, the S&P 500 fell 2.7 percent, its biggest weekly percentage loss since the week ending June 1, 2012. The Dow ended down 2.8 percent for the week, while the Nasdaq fell 2.2 percent. The Dow’s losses pulled it deeper into negative territory and is consequently down 0.5 percent for the year to date.

WTI Trades Near Six-Month Low Before Economic Data

West Texas Intermediate crude traded near the lowest price in six months before data that will signal the strength of the economy in the U.S., the world’s biggest oil consumer. Brent was steady in London. Futures were little changed in New York after capping the biggest weekly decline in seven months on Aug. 1. The Markit Economics purchasing managers index for U.S. services is due tomorrow, while factory order data is also scheduled this week. WTI for September delivery was at $98 a barrel in electronic trading on the New York Mercantile Exchange, up 12 cents. The contract slid 0.3 percent to $97.88 on Aug. 1, the lowest close since Feb. 6. The volume of all futures traded was about 1.3 percent above the 100-day average. Prices are down 0.5 percent this year. Brent for September settlement rose 21 cents to $105.05 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude was at a premium of $7.08 to WTI. It closed at $6.96 on Aug. 1.

That sums up today’s highlights! We hope you have a profitable day on the markets.