Here’s today’s ‘Just A Minute’ bringing you a 60 second summary of what’s happening in the financial markets:

Main Trading Event Of The Day: US Industrial Production @ 13.15 GMT

WHAT WE’RE WATCHING TODAY

Will The Fed Jolt The Markets This Week?

The Federal Reserve is expected to announce another $10 billion monthly reduction in quantitative easing in this week’s FOMC statement with the focus being on the Fed’s economic assessment, which could end up realigning investor expectations about when the Fed is likely to hike rates. In its last statement, the FOMC noted that growth in economic activity had picked up after having slowed sharply during the winter, but added that the labour market indicators were mixed and the unemployment rate remained elevated. However, the outlook has improved with the last two employment reports showing monthly non-farm payrolls growth of 282,000 and 217,000. And after a severely weak first quarter, several economists are looking forward to Q2 GDP growth around 4 percent. While the Fed is unlikely to alter its tapering plans or tweak its forward guidance, its new economic projections could still prompt speculation that the first interest rate hike may come earlier than mid-2015. Analysts are concerned that these new Fed jitters could crop up just as the market is running into geopolitical concerns surrounding the situation in Iraq and its impact on crude oil.

Asia Stocks Lower As Yen Gains On Iraq Conflict

Japanese stocks fell today as concerns over Iraq resulted in a stronger yen. The escalating conflict in Iraq continued to pressure market sentiment, pushing the cost of oil higher and sending investors toward the yen, Asia’s safe-haven currency. The yen edged a touch higher in Asian trade, with the U.S. dollar last at ¥101.84, compared with ¥102.04 on Friday. The stronger yen translated into falls for the Nikkei Average which was last down 0.7%. Australia’s S&P/ASX 200 lost 0.2%, as mining stocks dropped amid declining prices for spot iron ore, which fell 0.7% on Friday to a 21-month low. Concerns over the use of iron to finance deals and allegations of fraud involving commodities stored in China continue to rattle the market. In China, markets were mixed with Hong Kong’s Hang Seng Index down 0.2% and the Shanghai Composite was flat. Trading got off to a quiet start today, ahead of the U.S. Federal Reserve’s upcoming policy meeting. Scheduled to conclude on Wednesday, the meeting will provide a monetary-policy update for the world’s largest economy.

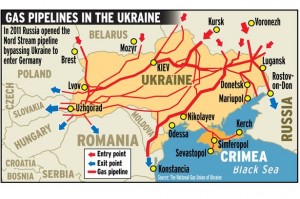

Russia/Ukraine Gas Deadline Passes As Talks Fail

A deadline for Ukraine to pay Russia its gas bill passed today after talks between the two sides failed to reach agreement. Russia will now switch to an advance payment system for supplying its eastern European neighbor, meaning that gas resources which also supply parts of wider Europe could potentially be shut off at any point. Russia has previously said that Kiev owes $1.95 billion for gas that has already been delivered. Under previous President Viktor Yanukovych, Ukraine had been paying a reduced price for the amount of gas that it was buying from Russia. However, after fierce street battles, a change of government in Kiev and the annexation of Crimea by Russia, Moscow ramped up the prices it charged to Ukraine. After several rounds of talks, with a representative from the European Union trying to help both sides reach a compromise, no clear solution has been found.

That sums up today’s highlights! Stay in touch throughout the day via our social media channels for all the latest market updates. We hope you have a profitable day on the markets.