McDonald’s, the company whose symbol is more popular the cross of Christianity, has a product which is probably the most well-known burger in the world, namely the Big Mac. The company’s flagship burger has also become a measurement tool for economists who use the price changes of the Big Mac to determine various economic aspects of a country’s financial health.

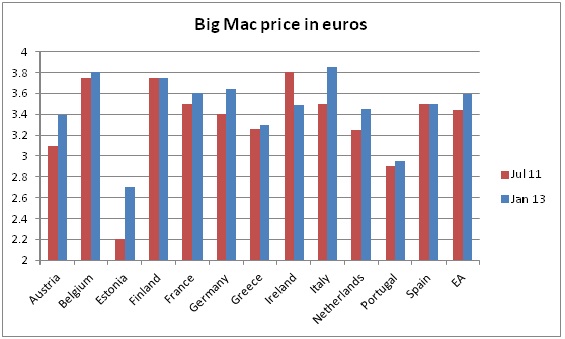

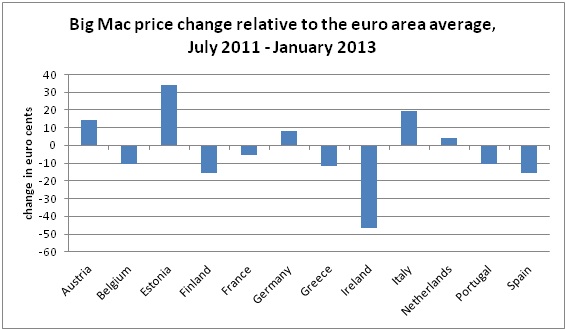

Source: Bruegel computation based on data compiled by the Economist.

Now one European think-tank and its innovative researchers have taken the Big Mac Index and morphed it into a variable which seems to suggest that countries undergoing severe austerity measures outperform on average countries with slacker economic policies. However, according to the researchers, Italy is the sole exception to the rule.

The Big Mac index was developed by The Economist in 1986 as a happy-go-lucky manual to whether currencies are at their “accurate” level. The index is centered around the idea of purchasing-power parity (PPP) determining that in the long run exchange rates should move towards the rate that would equalise the prices of an indistinguishable basket of goods and services (Big Mac) in any two countries. For instance, the average price of a Big Mac in America at the start of 2013 was $4.37. In China it was only $2.57 at market exchange rates which meant that the “raw” Big Mac index claimed that the Yuan was unappreciated by 41 percent at that time.

According to the kids at Bruegel and their Big Mac Standard, austerity-embracing Austria and Germany grow above average, while the spend-to-recover countries such as Greece, Ireland, Portugal and Spain are below average. Austerity-driven policies seem to be working not just for unit labour costs but even real prices are adjusting: