Here’s today’s ‘Just A Minute’ bringing you a 60 second summary of what’s happening in the financial markets:

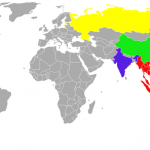

Main Trading Event Of The Day: G20 Meetings

WHAT WE’RE WATCHING TODAY

Gold On Track For Second Weekly Gain

Gold was trading near its highest in over 2 weeks on Friday, on track for its best week in a month. This followed minutes from the U.S. Federal Reserve’s last meeting at which monthly bond buying was cut for a third time, as tension in Ukraine persisted. The Fed has reduced monthly bond-buying by $10 billion at each of the past three meetings, while keeping its target for overnight lending between banks in a range of zero to 0.25 percent since 2008. Gold rallied 9.8 percent this year, rebounding from the worst annual drop in more than three decades, as the unrest in Ukraine, a rout in emerging markets and concern the U.S. recovery may be losing momentum spurred demand for a haven. Gold traded at $1,319.65 an ounce from $1,318.95 yesterday, when prices rose to $1,324.61, the highest since March 24.

WTI Heads for Weekly Gain Amid Speculation Of Increased U.S. Fuel Demand

West Texas Intermediate headed for a weekly gain amid speculation that U.S. fuel demand will increase as employment recovers. The discount to Brent decreased to the lowest since September after Libya signaled that it ready to boost crude exports. There are reasonable grounds for an ongoing improvement in the U.S. labor market in the next month or two which is good for demand and oil, with predictions that investors may sell West Texas contracts if prices rise to $105.20 a barrel. The other driving factor for oil is Libya and the negotiations about whether they’re going to restore some of their capacity. WTI for May delivery was at $103.06 a barrel in electronic trading on the New York Mercantile Exchange, down 34 cents. The volume of all futures traded was about 40 percent below the 100-day average. Prices have advanced 4.7 percent this year.

Google Glass Available To Buy Next Week

Google has announced that its Glass product will be available for purchase in the U.S. next week with interested consumers being able to buy online from April 15. Any adult in the US can become an Explorer by visiting the Google site and purchasing Glass for $1,500. Google Glass is available in various shades and frames. The tech giant said the number of spots in its newly extended Glass Explorer Program are limited. The product is currently not available outside of the U.S. but it will be interesting to observe initial user feedback and the reaction from the markets.

That sums up today’s highlights! Don’t forget to keep in touch with all the latest news and events for the day via our social media channels. We hope you have a profitable day on the markets.