Here’s today’s ‘Just A Minute’ bringing you a 60 second summary of what’s happening in the financial markets:

Main Trading Event Of The Day: USD Core Durable Goods Orders @ 12.30

WHAT WE’RE WATCHING TODAY

Wall Street Ends Down After Record High

U.S. stocks ended lower on Tuesday as concerns about Iraq drove profit-taking after encouraging economic data which had earlier driven shares to a record high. U.S. Treasuries prices gained as investors turned away from equities. The S&P 500 closed down more than half a percent for its sharpest loss since June 12, after setting a fourth record high in five sessions. The stock market was boosted earlier by data showing stronger-than-expected U.S. consumer confidence and an 18.6 percent surge in sales of new homes in May. But shares reversed course and fell more sharply toward the close on concerns about an escalation in the Iraq conflict. The Dow Jones industrial average fell 119.13 points to 16,818.13, the S&P 500 lost 12.63 points to 1,949.98, and the Nasdaq Composite dropped 18.321 points to 4,350.355.

GBP Falls After Less Hawkish BOE

The British pound dropped on Wednesday after comments from Bank of England governor, Mark Carney, cooled expectations for an interest rate hike this year. Surprisingly less hawkish comments from BoE Governor Mark Carney saw the pound dip to a near one-week low of $1.6966, pulling away from a 5 1/2 year peak of $1.7064 set last Wednesday. Carney said Britain’s economy still has plenty of slack to work through and that financial markets underestimate how much uncertainty there is in the economy. The impression he left was a dovish one and left market watchers trying hard to reconcile with his abrupt and hawkish change of policy signalling at a speech earlier this month.

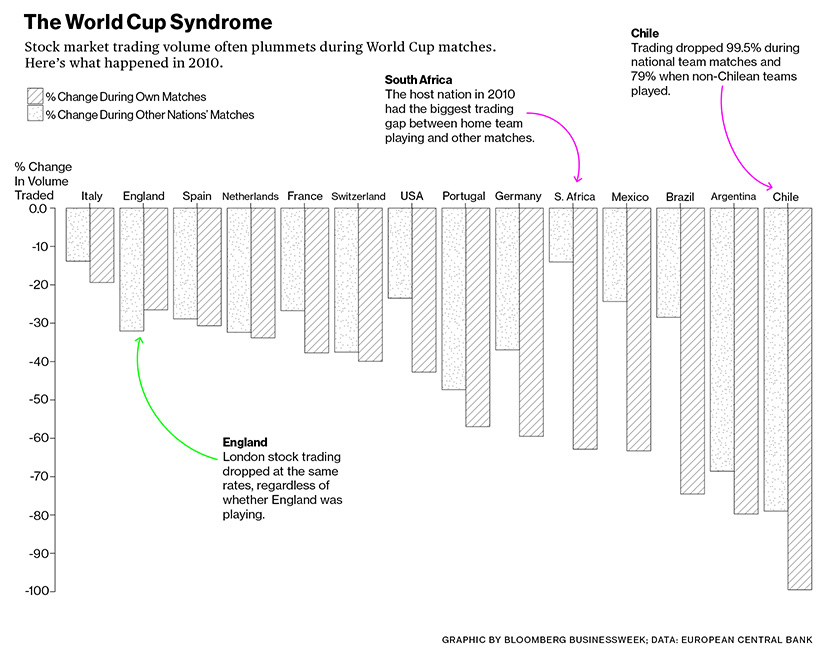

When The World Cup Is On, Stock Markets Go Quiet

With the World Cup well underway, it may come as no surprise that workers everywhere are paying more attention to the games than to their jobs. One way of measuring the global epidemic of distraction is to look at plunges in stock market trading volumes. The European Central Bank analysed data from the 2010 World Cup showing significant drops in trading during all games. The effect was especially pronounced when the traders’ own country was on the field.

Source: Bloomberg

That sums up today’s highlights! Remember to stay in touch via our social media channels for all the latest market news of the day. We hope you have a profitable day on the markets.