Here’s today’s ‘Just A Minute’ bringing you a 60 second summary of what’s happening in the financial markets:

Main Trading Event Of The Day: EU ECB Press Conference @ 12.30 GMT

WHAT WE’RE WATCHING TODAY

Ukraine Likely To Overshadow ECB Meeting

The crisis in Ukraine along with a hesitant recovery in Europe will most probably overshadow today’s European Central Bank meeting. Economists say the monetary authority for the member states who use the Euro will look to reassure markets that it is ready to add more stimulus measures if the economy takes a turn for the worse. It recently approved a major package of measures including a cut in the main interest rate to a record low 0.15 percent and an offer of more extra-cheap credit to banks and is waiting to see how those work. If further measures are deemed necessary in the future, analysts say the bank could decide to purchase large amounts of financial assets such as government bonds in the open market, a step which can drive rates down further and add newly created money to the economy but the bank is only expected to use it if its current efforts don’t work as expected. One risk factor is a sudden shock to business and investor confidence if the conflict between Russia and Ukraine escalates which could lead the EU and United States to impose new sanctions on Russia, disrupting trade. Uncertainty over what the impact could be on the global economy and markets could make businesses hold off on investing and consumers on spending. Low inflation is another worry for the ECB, at only 0.4 percent in the year to July. ECB President Mario Draghi has indicated that asset purchases are possible in the future and is one of the reasons why the euro has been in retreat over the past couple of months. ECB Press Conference is due today @ 12.30 GMT.

German Industry Output Grows Less Than Expected On Russia

German industrial output grew less than forecast in June as Europe’s largest economy came under pressure from political tensions with Russia. Production, adjusted for seasonal swings, rose 0.3 percent from May, when it declined a revised 1.7 percent. While that’s the first increase in four months, economists predicted a gain of 1.2 percent. Production fell 0.5 percent in June from the previous year when adjusted for working days. The European Union agreed last week on its widest-ranging sanctions yet over Russia’s backing of rebels in eastern Ukraine and the Bundesbank has cited geopolitical tensions as contributing to a probable stagnation of the economy in the second quarter. Factory orders fell the most in more than 2 1/2 years in June and sentiment surveys have plunged in Germany, Russia’s biggest trading partner in Europe. There is pessimism in the markets and it remains to be seen whether this pessimism will become persistent.

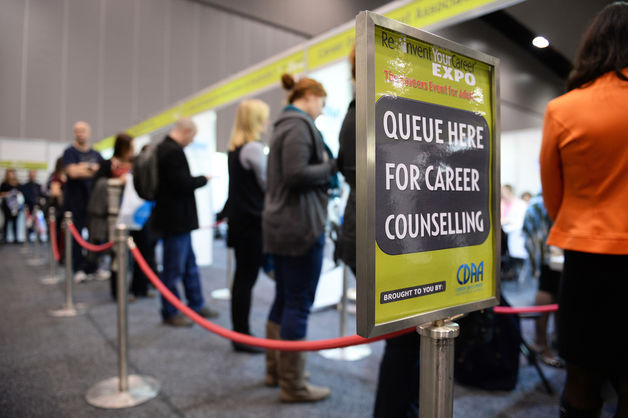

Australian Jobless Rate Tops U.S. First Time Since 2007

Australia’s jobless rate jumped to a 12 year high in July, overtaking the U.S. level for the first time since 2007 while sending the local currency falling. The unemployment rate rose to 6.4 percent from 6 percent according to the statistics bureau in Sydney, versus estimates for unemployment to hold steady. The number of people employed fell by 300. Australia appears to be losing its developed-world-beating status as the mining investment boom that powered it through the global financial crisis wanes. The number of full-time jobs increased by 14,500 in July, and part-time employment fell 14,800, today’s report showed. Australia’s participation rate, a measure of the labour force in proportion to the population, climbed to 64.8 percent in July from 64.7 percent a month earlier. The Australian dollar was trading at 92.87 U.S. cents at from 93.43 cents before the data were released.

That sums up today’s highlights! Don’t forget you can find us throughout the day on the social media platforms delivering u-to-the-minute news for traders. We hope you have a profitable day on the markets.