Here’s today’s ‘Just A Minute’ bringing you a 60 second summary of what’s happening in the financial markets:

Main Trading Event Of The Day: U.S. Non-Farm Payrolls @ 12.30 GMT

WHAT WE’RE WATCHING TODAY

ECB: Market-Watchers Look to Draghi for Clarity

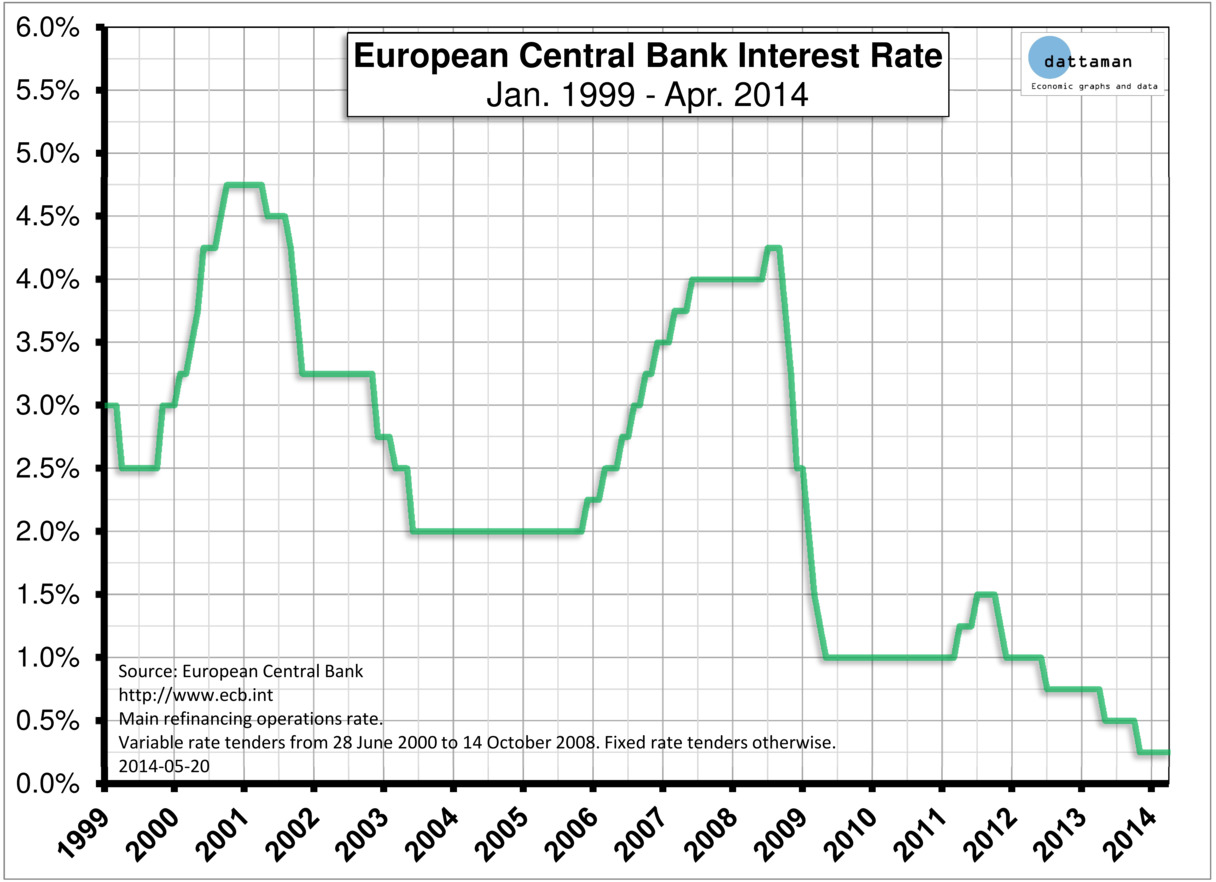

A month after the ECB president, Mario Draghi introduced a varying range of fixes for the euro area’s faltering recovery, market-watchers are in disagreement about how long interest rates will stay near zero and remain unclear on the details of plans to boost lending. Draghi may use today’s appearance in Frankfurt as an opportunity to clarify the situation. As the Federal Reserve and the Bank of England work their way out of crisis-era support for their economies, the ECB continues to steer against the risk of a relapse. Draghi’s guidance on how he expects rates to develop over the next two to four years, if he decides to give any, will be crucial in bolstering investors’ optimism that the worst is truly over, while reassuring them that protection won’t be removed before they’re ready.

The euro is currently trading below $1.37, roughly where it was when the ECB met on June 5 but down from over $1.39 before the ECB flagged the cut in May. The ECB is keeping a close eye on the euro to gauge its impact on already low inflation. Euro zone inflation stood at 0.5 percent in June, well below the ECB’s medium-term target of just under 2 percent. Should the outlook for inflation deteriorate, Mario Draghi has said that the ECB would consider quantitative easing to keep borrowing costs low and boost spending.

Asia Stocks Fall Along With Gold; Dollar Gains Before Data

Asian Stocks fell from a six-year high, while precious metals dropped as the U.S. dollar gained versus its major peers before today’s jobs reports and a euro-area monetary-policy decision. The MSCI Asia Pacific Index slipped 0.2 percent while Standard & Poor’s 500 Index futures lost 0.1 percent. The Aussie slid 0.7 percent, trading at 93.78 U.S., cents after Reserve Bank of Australia Governor Glenn Stevens said investors are underestimating the chance of currency losses. Oil in New York fell for a sixth day, its longest slump since May 2012. Australia’s currency also slid as the country’s central bank governor said it was overvalued. The Aussie is more than just a few cents overvalued and the risk of a significant fall is being underestimated according to Stevens.

The U.S. Non-Farm Payrolls report comes after yesterday’s ADP data showed U.S. employment rose in June by the most since 2012, with more workers hired than economists projected. The European Central Bank meets today after enacting unprecedented stimulus last month, while in Asia, data on services industries is due.

Watch For Google’s Streaming Music Service…

With its Songza deal, Google could end up dominating other streaming music services if it becomes the default option on Android mobile devices due to Android’s dominance among mobile devices and Songza’s ability to curate and recommend new music to its users. Android devices make up nearly 62 percent of the U.S. market for smartphones, according to research as of May 2014. With the Songza move, Google pitches itself against Spotify, Pandora and Rdio as well as Apple, which acquired Beats Music and its streaming service, and Amazon, which recently launched a streaming music service for its Prime customers. The deal could be a win for Google’s advertising business. Keep an eye on Google stocks…

That sums up today’s highlights. It’s Non-Farm Payrolls day today so a busy day on the markets. Don’t forget you can stay regularly updated on events by visiting our Facebook, Twitter, Google+ and LinkedIn pages.

We hope you have a profitable day on the markets!