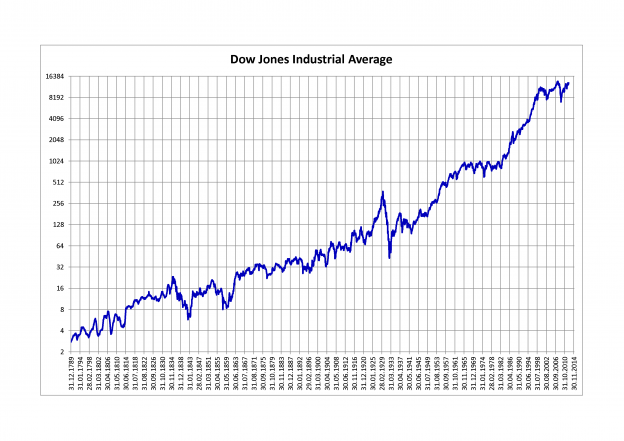

Markets are performing well, US stock indices are shooting higher, euro is stable and the yen is looking sturdier by the day. Are positive developments in the market an indication that the US, eurozone and Japan are recovering from their respective financial crises or do markets have a life of their own, irrespective of a country’s economic health?

The positive employment news coming out of the US would lead one to assume that things are fine and dandy in the largest economy in the world. However, as Stephen Gandel points out, the number of jobs added in February should have been 13 per cent than the actual number reported. In fact, if the economy correlated with the market, the number of jobs should have been 150,000 higher.

The S&P, Dow and Nasdaq jumped on the news of seemingly good jobs numbers. However, would anyone honestly claim that the US is doing well? Trading on the news is not necessarily a good strategy because markets don’t always react in a rational manner.

For instance, markets have largely ignored Italy – except for a brief moment after the election – where Beppe Grillo is about to claim a prominent role. Why would the euro stay steady when a man who has vowed to take Italy out of the euro could very well be in a position to carry out his promise? Last summer Finland was erroneously reported to have threatened to leave the euro. The rumour prompted the single currency to fall, but now, when the third largest economy in the eurozone is rumoured to do the same, the euro is stable.

Open an Account