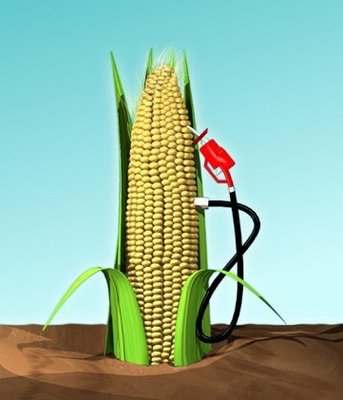

Although corn demand has been growing in the U.S., the world’s top corn grower has also put out a record crop this year that has seen stockpiles rise at the quickest pace in the last 19 years. Corn is used primarily to make livestock feed and ethanol.

On the first stock-taking at the end of harvest, in 1st December, reached around 10.764 billion bushels (273.4 million metric tons), and increase of 34 percent from just the year before. The number, in fact, has exceeded every inventory taking since 1994 and plentiful supplies could extent the drop in March futures by 10 percent.

A drought in 2012 had sent prices skyrocketing leaving reserves struggling to recover and spurring an output increase in producers from the U.S. to Brazil and Ukraine. Last month’s harvest, however, seems to have exceeded even the most optimistic of expectations, even as corn futures dropped 40 percent last year, leading the general commodity slump that has pushed global food costs down by 14 percent.

Experts anticipate that with the new figures in place, demand will take over two years to catch up to the surplus supply.