Are we living in a material world? To a larger or lesser degree, the answer has to be ‘yes’ but it does seem that to what degree depends on where you live.

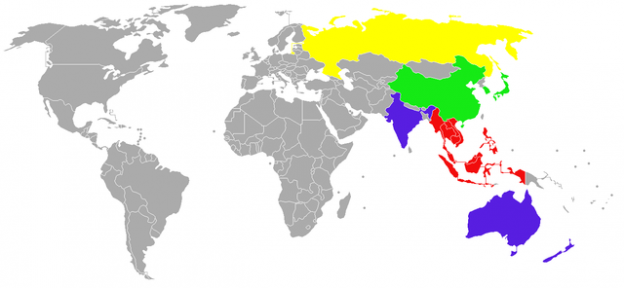

In a recent poll of 20 countries conducted by global market-research company Ipsos regarding their attitudes toward wealth and success, findings were that those in China were the most likely to equate success with material possessions, with 71 percent agreeing with the statement “I measure my success by the things I own.”

Perhaps it’s no coincidence that the next three countries were also large emerging markets, implying that people’s views may be shaped not only by culture, but by stage of national development: 58 percent of respondents in India agreed with the same statement, while 57 percent in Turkey and 48 percent in Brazil. In the more affluent US, the figure was 21 per cent.

People in China were also the most likely to say “I feel under a lot of pressure to be successful and make money,” with 68 percent agreeing. A separate global poll last year by U.K office-space company Regus, found that Chinese workers were also the most likely to report increasing stress levels over the past year.

Meanwhile, people in India were the most likely to be hopeful about their country as a whole over the next year, with 53 percent expressing optimism. Forty-six percent of people in China expressed optimism, well above the global average of 32 percent. The most pessimistic were those living in Spain, Italy and France, perhaps not surprisingly considering their recent financial woes.

So, does being well-off financially equate with success? That depends on how you measure your own personal success. What do you think?