What would happen if interest rates worldwide dropped even lower and stay down for many years to come? What if much more bond-buying lies ahead? Yes, the Federal Reserve plans to reduce its bond-buying, leading us to the assumption that we are finally on the way towards tighter monetary policy after years of unprecedented stimulus efforts. But what if this is just a diversion?

Many of the world’s policymakers have hinted at this lately, and if they are right, we should expect even bigger gains in stock markets and higher gold prices, as well as international currency tensions, not to mention rising real estate prices in selective city centres. There may even be potential political repercussions for those excluded from this hypothetical jackpot. Last month saw perpetuating policies that have left the interest rates of developed countries near zero while inflating central-bank balance sheets. Now, people are suggesting that policy “normalisation” is too far in the future to even contemplate.

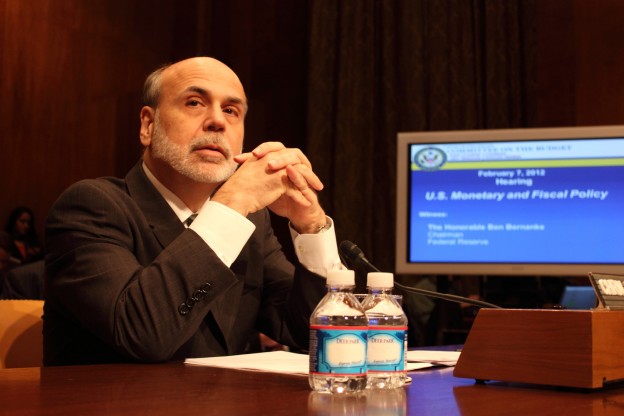

Should the Fed lower the unemployment rate target? Chairman Bernanke has hinted that the Fed could incorporate this revision into its “forward guidance” policy, saying that rates could stay near zero “well after” the jobless rate fell below 6.5%. At an International Monetary Fund event Lawrence Summers, the former Treasury Secretary, argued that the U.S. economy is trapped by “secular stagnation,” which has left the natural rate of interest far below zero. In other words, he was saying that we need even more aggressive policies to get around the “zero bound” floor on the Fed’s target interest rate.

But what does all this imply for future policy? As Bernanke and Summers discussed in an exchange after his speech, fiscal policy would be the ideal solution. That could include an immediate burst of targeted spending on infrastructure projects and an end to blanket austerity measures in the U.S. and Europe, while also reducing long-term government commitments on health care and social security.

But the current political climate prevents such sensible solutions in many countries. Instead, central banks may be driven to larger rounds of bond-buying and maybe even a deliberate strategy to create inflation by adopting nominal GDP targets. A continuous easy monetary policy may deepen the divisions within and between economies; the gap will widen between the few who benefit from financial market advances and the many who don’t. Despite the irrefutable weakness in consumer-price inflation that is provoking all these discussions, asset inflation is a real problem that is not that easy to get rid of. The ever-widening global wealth gap cannot so easily be separated from easy-money policies. If political solutions are purely localised and fail to address the extensive, global imbalances that are generating the stagnation we’ve been experiencing, the real problem will never get resolved.