Here’s today’s ‘Just A Minute’ bringing you a 60 second summary of what’s happening in the financial markets:

MainTrading Event Of The Day: USD Prelim UoM Consumer Sentiment @ 13.55 GMT

WHAT WE’RE WATCHING TODAY

Asian Stocks Slip After Malaysian Plane Shot Down

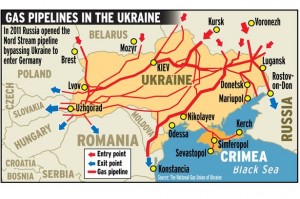

Asian stocks fell from near a six-year high, after one of its planes was shot down in Ukraine yesterday. The MSCI Asia Pacific Index slipped 0.5 percent by 12:51 p.m. in Tokyo, falling for the first time this week. Malaysian Airline shares tumbled 8.9 percent. Standard & Poor’s 500 Index futures fell 0.1 percent after the U.S. gauge’s biggest drop in three months. Ten-year bond yields in Australia and Japan traded near the lowest in more than a year, while a gauge of credit-default swap prices jumped five basis points. Oil in New York added 0.5 percent. With geopolitical risk in Ukraine and the Middle East, people are concerned the stock market won’t be a safe place to invest and have turned to bonds. European shares are also set for a lower open today with the FTSE called down 25 points at 6,713 and the German Dax by 57 points at 9,696.

Meanwhile, oil prices rose after Israeli Prime Minister Benjamin Netanyahu announced the start of a ground campaign in Gaza. The decision came as a surprise as officials from the Palestinian authority and Israel were believed to be progressing in talks in Egypt aimed at a lasting cease-fire.

Gold Climbs As Plane Crashes

Gold rallied yesterday as a Malaysia Airlines crash in Ukraine near the Russian border revived haven demand. Gold for August delivery rose $17.10, or 1.3%, to settle at $1,316.90 an ounce. Traders also took into consideration a weaker than expected report on U.S. housing starts, although that was offset by a stronger-than-anticipated figure for weekly jobless claims. A day earlier, gold put an end to a three-day losing streak by moving fractionally higher, as traders continued to digest Federal Reserve Chairwoman Janet Yellen’s mostly dovish testimony. Elsewhere in metals trading, October platinum rose by $18.00, or 1.2%, to $1,503.70 an ounce. Bloomberg reported platinum prices were trading at a 13-year high after sanctions imposed on Russia, which is a major producer of the industrial metal.

Google Earnings Miss Expectations

Google reported earnings that missed expectations while revenue topped Wall Street estimates on yesterday. Shares rallied in extended hours trading. The Internet giant reported earnings of $6.08 per share, excluding one-time items, on revenue of $15.96 billion. Analysts had expected the company to report earnings excluding items of $6.24 a share on nearly $15.62 billion in revenue. Revenue for Google increased 22 percent in the second quarter as it saw strong demand for ads on its websites. Analysts had been expecting the Internet giant to discuss falling online ad prices, which remain Google’s biggest source of revenue. Google will account for more than a third of global digital ad spending this year according to Dow Jones.

That sums up today’s highlights! Remember to keep an eye on all the latest economic developments of the day via our Facebook, Twitter, LinkedIn and Google+ pages. We hope you have a profitable day on the markets.