Here’s today’s ‘Just A Minute’ bringing you a 60 second summary of what’s happening in the financial markets:

Main Trading Event Of The Day: NZD Official Cash Rate @ 17.00 GMT

WHAT WE’RE WATCHING TODAY

Facebook Earnings: Favourable Performance Expected To Continue

Facebook’s Q2 2014 results are due today with expectations high considering the company’s performance in recent quarters. Analysts expect a significant year over year jump in ad revenues driven by higher ad pricing and the number of ad impressions. Although Facebook’s user base growth has slowed down, its revenue growth has accelerated on the back of innovation in ad format and delivery. Mobile will remain the focus, with the the mobile platform’s revenue contribution nudging close to 65%. Market watchers will be looking at how the company performs in international markets which is where the most of its incremental growth will come from in the future. Facebook saw 82% growth in its ad revenue during the first quarter of 2014, which was primarily driven by a 118% increase in its average ad pricing. This eclipsed Q4 2013 ad pricing growth of 92%, which is encouraging considering tougher year-over-year comparison. The growing proportion of feed-based ads was the primary reason behind this success.

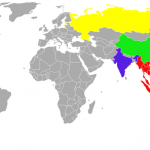

In the coming quarters, Facebook is likely to focus on improving its monetisation in international markets. The push comes from the fact that despite harbouring most of the world’s population, Asia, Africa and South America haven’t contributed much to Facebook’s revenues suggesting that Facebook has a tremendous opportunity to increase monetisation in international markets.

Europe Shares Set For Lower Open

European shares are geared up for a lower open today after previous gains amid ongoing geopolitical concerns in Gaza and Ukraine. The FTSE is called down 15 points at 6,780 while the German Dax is seen lower by 22 points at 9,712. The European Union failed to announce any tough sanctions against Russia at a meeting on Tuesday. The U.S. was hoping for stricter penalties to be placed on Russia to push the country into cooperating with an international investigation into the downed Malaysian jet and calming the separatists in the eastern part of Ukraine. EU ministers drafted possible sanctions that could stem access to financial services and technology but they failed to put in place broader penalties.

Asian stock markets were mixed today with investors opting to book profits. U.S. stocks rose on Tuesday, lifting the S&P 500 to a record as Wall Street focused on quarterly earnings and fresh data releases.

Apple Beats Expectations On Strong IPhone Sales

Apple reported its second straight quarter of double-digit percentage growth in iPhone sales yesterday as it heads into a major update of its flagship product. The company sold 35.2 million iPhones in the quarter ended June 28, up 12.7% from the 31.2 million units in the year-ago period. The latest figure was just short of analysts’ projections for sales of 35.9 million iPhones. Strong iPhone sales were driven by demand from Brazil, Russia, India, and China with sales in those countries rising 55%, including a 48% increase in China alone. In the past few years, the June quarter has been the slowest for Apple as the company gears up with new products ahead of the year-end. Apple is counting on an expected new product push of larger iPhones and smart-watches before year-end to revitalise earnings that have flattened after more than a decade of remarkable growth, raising concerns that Apple is losing its innovative touch. Apple’s third quarter profit was $7.75 billion, up 12.3% from $6.9 billion in the year-ago period while earnings per share rose to $1.28 from $1.07. Revenue rose 6% to $37.43 billion from $35.32 billion in the same period a year earlier.

That sums up today’s highlights! Remember to keep in touch via our Facebook, Twitter, Google+ & LinkedIn pages for all the latest news on the days trading activities. We hope you have a profitable day on the markets.