Here’s today’s ‘Just A Minute’ bringing you a 60 second summary of what’s happening in the financial markets:

WHAT WE’RE WATCHING TODAY

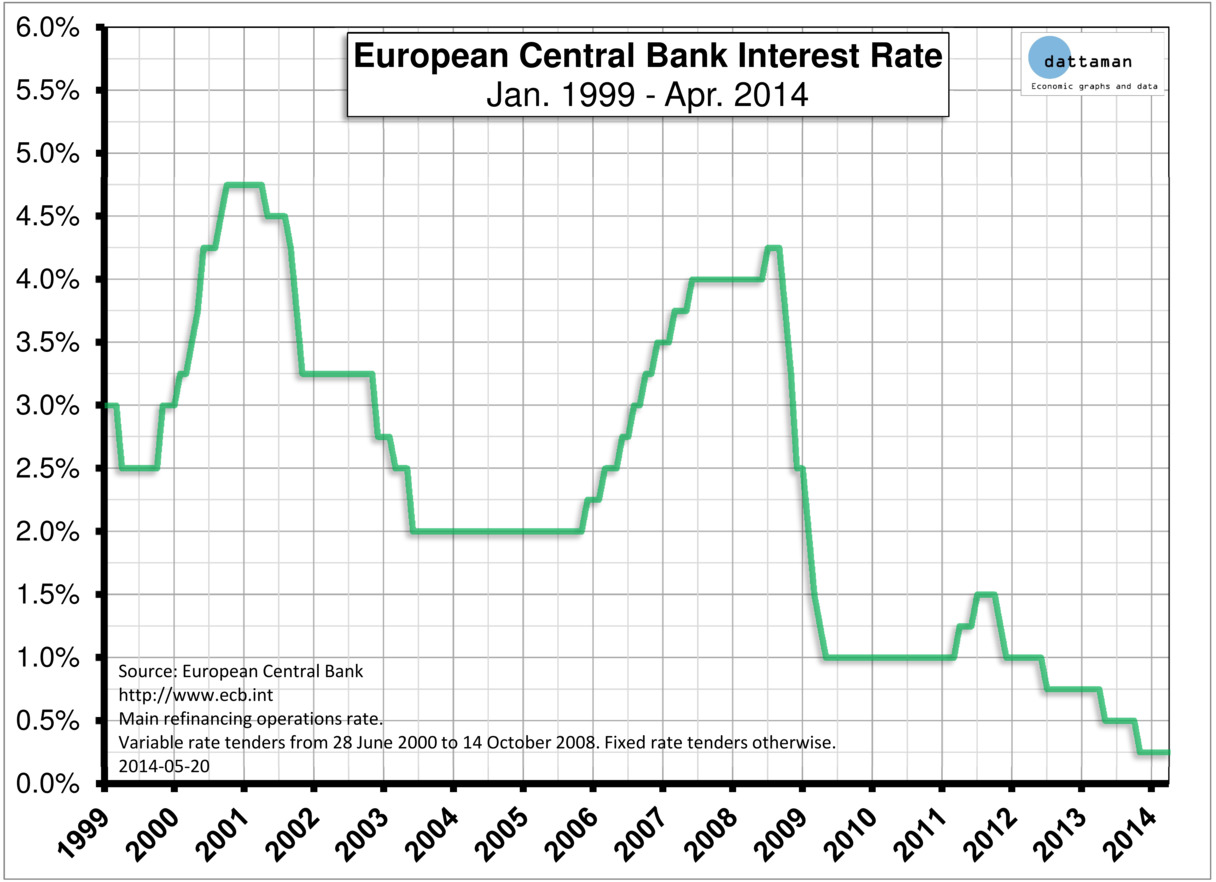

ECB Set To Cut Rates Driving Banks Into Lending

The European Central Bank is set to impose negative interest rates on its overnight depositors, seeking to push banks into lending and to prevent the euro zone falling into deflation as experienced in Japan. At today’s meeting, ECB policymakers are also expected to launch a loan program for banks with strings attached to make sure the money actually gets out into the euro zone economy. Even though the risks are limited of the euro zone entering a spiral of falling prices, slowing growth and consumption, the ECB is increasingly concerned that continuously low inflation and weak bank lending could upset the recovery. The economy grew just 0.2 percent in the first quarter, and euro zone annual inflation unexpectedly slowed to 0.5 percent in May, putting additional pressure on the central bank to step in. A broad stimulus package may be in the making that is likely to consist of a cut in interest rates which would push the deposit rate for the first time into negative territory and the offer of longer-term loans linked to further lending. Large-scale asset purchases remain a distant prospect. Cutting the deposit rate below zero would see the ECB charge banks for parking their excess money at the central bank, a step it hopes will prompt them to lend out the money instead. The euro has fallen about 4 U.S. cents against the dollar since the ECB’s May meeting, hitting $1.3586 last Thursday. Before taking any decision, the Governing Council will look at the June update of its quarterly staff projections. In March, they showed it would take 2-1/2 years for inflation to get near the ECB’s target of below but close to 2 percent. A deteriorating outlook will be seen as triggering action although a move to deploy so-called quantitative easing remains some way off.

Nikkei Touches Two-Month High. Is it Just The Start?

The Nikkei touched a two-month high this week, a sign of lessening concerns about Japan’s economy, according to analysts who remain bullish on Japanese stocks. Stocks powered higher on Thursday, to reach 15,141 soon after open, its highest level since April 3. Last year, plans to boost Japan’s economy through aggressive easing, fiscal stimulus and structural reform saw the Nikkei rise 55 percent, while the yen depreciated 21 percent against the U.S. dollar boosting exporter stocks. However, the Nikkei fell 8.2 percent during the first quarter of 2014 amid concerns about the impact of a consumption tax hike to 8 percent from 5 percent in April. Companies were afraid that Japan’s economy would lurch back into the dangerous deflationary spiral that the last tax hike prompted in the 1990s but the economy has proved resilient, and Japan’s core consumer prices jumped 3.2 per cent in April from a year earlier, the fastest gain since February 1991. Meanwhile, investors have also turned more positive on progress on structural reforms. This week Japan’s corporate tax rate was cut, one of the structural reforms investors were worried might not come to fruition. Japan’s corporate tax rate currently sits at around 35.6 percent, among the highest in industrialised nations. The release this week of a draft of the government’s growth strategy has also powered stocks higher.

WTI Falls for Second Day Amid Record U.S. Supply

West Texas Intermediate fell for a second day as crude stockpiles remained near record-high levels amid declining fuel demand in the U.S., the world’s biggest oil consumer. Futures dropped as much as 0.4 percent in New York. Crude supplies shrank by 3.43 million barrels to 389.5 million last week. They were at 399.4 million through April 25, the most since the Energy Department’s statistical arm started publishing weekly data in 1982. There is still concern that the market is oversupplied. WTI for July delivery declined as much as 45 cents to $102.19 a barrel in electronic trading on the New York Mercantile Exchange and was at $102.34. Brent for July settlement decreased as much as 40 cents, or 0.4 percent, to $108 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude traded at a premium of $5.98 to WTI.

That sums up today’s highlights! Keep checking in regularly via our social media channels for all the latest trading updates and news. We hope you have a profitable day on the markets.