http://www.financialmirror.com/news-details.php?nid=31168

For The Professional Investor

For The Professional Investor

http://www.financialmirror.com/news-details.php?nid=31168

Guess who has just come back from a fabulous weekend in Italy’s financial capital, Milan? Oren Laurent, Wendy Kenny and Liam Fletcher are pictured here at the IAIR gala dinner and banking awards on Friday night, where Banc De Binary was honored to win the award for our global leadership and excellence in binary option trading. The ceremony was spectacular, the food met high Italian standards, and you’ll be glad to know there was also a little spare time for shopping!

Accepting the award, CEO Oren Laurent commented:

“Banc De Binary is privileged to receive this award for excellence in binary options trading. I dedicate the achievement to our employees and thank them for their exceptional hard work and commitment. Their willingness to always go the extra mile, be it developing new platform features or giving one-on-one lessons to customers, is why we can proudly offer the very best binary options experience. We promise to continue innovating and leading the industry with simplified trading solutions for the 21st century investor.”

A recent poll suggests that Americans are beginning to lose faith in the nation’s economic recovery, even though all signs are pointing to recovery and growth. The poll, conducted by Bloomberg, has shown that only 27% of people believe the U.S. economy will strengthen this year, 12% less than when the same survey was conducted in June. Twenty-eight percent of those polled see the economy weakening in 2014, while 44% believe it will remain the same (despite the fact that is has expanded for nine consecutive quarters). Chris Sams, a 28 year-old Navy veteran from Daingerfield, Texas said, “We’re still in a recession; I don’t know why they say it’s over. It may be over in Washington, D.C., where the per capita income is higher than anywhere else, but down here the minimum wage is the highest wage.”

Ever needed someone to confirm a phony reference to a prospective employer? Took a sicky without there being anything strictly wrong with you? Need an alibi for the wife? Well a resourceful ex-private detective has been filling this niche since 2009 by offering his services to clients as a professional liar. Semi-retired private eye Tim Green insists that there is nothing ethically wrong with his upstart company, despite the fact that last month Facebook removed advertisements for its services. “I believe that my moral compass is intact, we are not breaking any laws, and if we help people out, I feel we are doing a positive service. I consider it disinformation. I consider it business.” With five employees and over 250 clients regularly taking advantage of his truth distortion facilities his blue sky thinking looks like it’s paying off.

As far as utterly useless products that make you look twice go… Well, we have to say that these new novelty pen caps from Dine Ink have raised the bar of pointlessness while still managing to intrigue us enough to place an order for the office. For companies seeking to maximise the productivity of their employees while saving money on disposable plastic cutlery, and doing their little bit to save the planet, this may be just the thing. According to the company responsible for bringing this wonderful novelty to the market they are: “Perfect for on-the-go eating and note taking.” Never found yourself working through lunch with some leftover chicken chow mein, and no way to eat it other than your bare hands? No? Well alright then.

A report published today places the United States back in pole position as far as foreign direct investment sentiment is concerned. This is the first time since 2001 that the US has found itself atop the list, having nudged China from the top spot it occupied in 2012. Despite uncertainty as to the Federal Reserve’s future policy regarding quantitative easing, it seems that investors believe that the US economy is taking the right steps away from recession and towards a new period of sustainable economic growth. The Foreign Direct Investment Confidence Index surveys over 300 executives over 28 countries on an annual basis. 2013’s report was conducted between October and November of 2012 and saw the United States rising from fourth place since last year’s report.

Dear Investors and Traders,

I welcome you to the exciting world of online trading!

If you are reading this, you must be ready to embark on the great journey of binary option trading. You are keen to invest in a financial education and you are looking to generate money through the trading markets.

Before you go any further on your journey, let me share a little of the wisdom of Benjamin Graham, one of the most influential economists and investors. Graham urges us to create a fundamental distinction between investment and speculation. He argues that “an operation of investment is one which, based on analysis, offers safety and adequate gain, and anything that does not meet this is speculation.”

What does he mean? Graham’s point is that to be a successful when trading, we need to make informed choices based on proper analysis. Don’t just guess and speculate on the direction of an asset. Study it, research it, understand it.

I encourage all my clients, like I encourage you now, to approach binary options as investors not speculators. You’ll enjoy higher returns when you actively engage in the markets and understand the rules of trading.

Perhaps the highlight of my day at Banc De Binary is working with young professionals and entrepreneurs because these guys love to be smart when it comes to investing. They want to learn the tricks of the trade even though they are still at the age where savings are less important than wages. They are happy to take risks and are not deterred by setbacks.

While there is a great advantage for the young capitalist in beginning their education and financial experience early, I would argue that there is no such thing as starting too late. I urge those who are novices in the financial markets, whether young or old, not to waste your effort and money trying to beat the market. Instead, study and respect the markets. Be open to learning new strategies. And most importantly, make sure that you have a broker on your side who can provide tailored educational materials.

Once you understand the general principles of trading, you need to consider each specific trade like an investor, not a speculator. An investor approaches the analysis of assets with a business mindset and makes intellectual decisions. Will the value go up or down with respect to the current price? Is the asset currently undervalued or overvalued? The beauty of binary option trading is that you only have to determine the direction of the asset. Trading is far simpler than in forex or traditional stock trading where the exact price points matter.

Analysis of political events, stocks, and charts, will help you to decide the market direction of an asset. Make sure you understand the asset’s worth, just as you would know the value of the goods, product or service you produce, buy, or trade. Although in online trading, you are often driving your business with your broker’s recommendations, it is still you who ultimately oversees and manages your investments. So it is better to apply care and long-term money management strategies.

When you make trade decisions based on calculation not optimism, you should have confidence that your judgement is solid. And confidence in the financial markets is the single largest virtue after adequate knowledge.

After all, a strong market trend is not synonymous with security. Binary options, like all investments, involve a degree of risk, and even the best of us do not get it right 100% of the time. However, with knowledge and confidence, you will not be hurt by a loss. When your data and reasoning are correct, you can trade with confidence in your decisions and with the belief that next time you could be in-the-money again. You are investor, not a speculator.

My friends, achieving satisfactory investment results is easier than people think, but should never be taken for granted.

Invest well!

Ben Franz

Ben Franz is one of Banc De Binary’s Senior Account Executives. For further trading tips and signals, follow @bdb_benfranz on twitter, or email him directly at [email protected]

This week we take a peek behind the scenes of Banc De Binary’s German desk and talk to senior account manager Daniel Clay about the path that led him to Banc De Binary, the personal touch, and riding horses.

Daniel, thank you for giving us a few minutes of your time.

That’s quite alright, I see these interviews as an essential part of the job, is there anything specific you would like to kick off with?

Yes, if you could, please give us a brief run-down of the journey that brought you to Banc De Binary.

Right, well let’s start at the very beginning then. I started my career in finance at Deutsche Bank in Augsburg. My first role with them was as an assistant Manager in the compliance and disputes department. It proved to be very educational and an important formative experience in my development as a senior account manager.

So you’ve experienced dealing with clients on both sides of the trading desk.

Exactly, those years were very important in helping me develop my own way of addressing clients. Sometimes in the frenzy to get results people can forget that every client is different and comes with a unique set of needs. My experience in compliance and disputes has made it impossible for me to overlook this, I address each of my clients as if they are my only one, I know the times they trade, their backgrounds, even the names of their children and pets!

How did you transition from your role at Deutsche Bank to being a binary options senior account manager?

My third year in Germany I came across a derivative Deutsche Bank was offering its customers which was very similar to the binary options that have become so popular on the online market today. The dynamics of this particular instrument intrigued me greatly. I spent a great deal of my own time researching the subject, seeing which existing strategies could be adapted to binary trading how the advantages of these short-term, high reward investments could be maximised through the adoption of certain trading practices. Anyway to cut the story short it wasn’t very long before Banc De Binary came to my attention.

How did you end up making the move?

I caught the industry just as it was about to explode, a brief talk with a Banc De Binary recruiter at a Forex Expo led to an offer for an apprenticeship. This involved me taking a step down from the management role I was in at Deutsche Bank but I believed in the product and I knew it was the right decision to make. I think my choice proved to be the right one.

You’ve also moved about quite a lot within the company itself haven’t you?

Yes, and I still do. I spent some time in our London office when we were launching our European campaign. Now I’m in charge of the German campaign and this involves a lot of to and fro from Frankfurt, it’s showing signs of being a great success and we’re also expanding into the Swiss and Austrian markets.

Any other projects you’d like to share with us?

Yes actually, I’ve just started giving seminars in binary options trading, which I’m very excited about. It’s nice to meet the traders in person and help them develop their trading techniques.

Recently we held a seminar at Humboldt University in Berlin which was great fun and had a very good turnout.

With such a busy work life do you even have time for hobbies?

I think it’s important to make time for your passions, regardless of how hounded you are at work. I love playing polo and horse riding. No-matter how full my schedule is I always find the time to get out and go for a ride, I always come back refreshed and ready for another heavy session on the markets.

Contact Daniel Clay, Senior Account Manager, Banc De Binary at: [email protected]

Just as we predicted when the Cypriot bail-in debacle was in full swing a few months ago, it seems that Cyprus was indeed the test case for an EU-wide model of dealing with failed banks. We can’t possibly take all the credit for the accuracy of our assessment, especially when on the 25th of March Eurogroup president, Jeroen Dijsselbloem, accidentally likened the Cypriot bailout negotiations to a “template” that could be used again in other future bailout situations. A frenzy of back-peddling via Twitter ensued, with Dijsselbloem spinning his template remark into a “tailor made” case in which “no models or templates” were used.

Cut to the 21st of June, where finance ministers are due to meet in Luxembourg in order to agree upon a unified way of dealing with failed banking institutions. With a third of the EU’s economic output since the 2008 crash having been spent on saving failing banks, clearly a set of measures is needed to safeguard the future of the union, and these measures are starting to look suspiciously like what took place in Cyprus in March.

“The costs of future restructurings can’t be wished away,” a senior EU official commented, “We need a mechanism to shift the burden away from taxpayers.”

The main solution up for discussion proposes that in the case of future bank failures the first to be affected should be shareholders in the bank in question, then bondholders and finally depositors with more than 100,000 euros in their accounts. Sound familiar? And are we the only ones to observe that this proposal certainly does hit taxpayers, albeit those with more liquid capital.

The proposed measures are likely to divide Europe’s leaders, with both France and the United Kingdom having voiced their resistance to putting a mechanism in place that cedes the final word to Brussels. On the other end Germany is demanding that such a framework be put in place and uniformly applied throughout the 27 EU member states before the 60 billion euros earmarked for the European Stability Mechanism is made available.

We will keep you informed as the story develops but it certainly seems that a bail-in/out à la Cyprus could be coming to an imploding banking sector near you.

The above question, a mainstay in introductory public speaking and debate courses, is taking on a whole new resonance. Everybody knows that the Federal Reserve has been artificially keeping the U.S economy afloat with $85 billion each month in asset purchases. Everybody knows that there is an ever-growing divide between the way the markets have been performing thanks to QE, and the fundamentals affecting the daily lives of U.S citizens. Everybody knows that this can’t carry on indefinitely, that sooner or later something has to give. What not everybody knows is that there are many signs on the ground indicating this could be sooner rather than later.

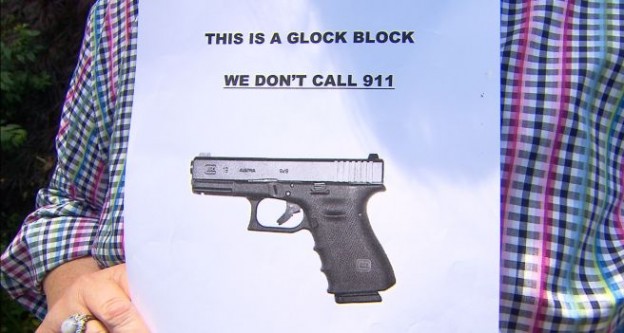

Ask the members of a community group in Milwaukie who have posted ominous signs around their neighbourhood which read: “This is a Glock block. We don’t call 911” complete with a picture of a Glock semi-automatic pistol. With police budgets being slashed all over the U.S and crime on the rise, many people are now taking matters into their own hands and are starting to police their own streets. One of the founding members of the above community project is breast cancer survivor Coy Tolonen, who decided to start arming herself after a burglar stole a prized statue off her porch in broad daylight, with her in plain sight.

In the former industrial powerhouse of Detroit things are even worse, America’s most dangerous city for the last four years running has a police force that has lost a quarter of its numbers since 2009, and a murder, rape, robbery and assault rate that is five times the national average. Detroit is currently running a $380 million budget deficit, with vast swathes of the city (around 40%) abandoned as the authorities are unable to provide basic services and patrols for its streets. A solution currently being tested is the employment of unarmed civilians with radios to aid the police by reporting crimes. These budding eyes and ears of law enforcement are doing all they can to help hold a crumbling city together.

In Oakland, in a move more reminiscent of South-Africa than the United States, wealthy citizens are coming together to hire private security firms to patrol their neighbourhoods. In fact if there is an American industry genuinely growing at the moment it is this one.

“With less law enforcement on the streets and more home crime or perception of home crime, people are wanting something to replace that need,” says Chris de Guzman, chief operating officer of First Alarm, which provides private security services for 100 homes in Oakland.

Private security firms are in fact springing up all over the U.S, with a focus on particularly crime-stricken areas such as Atlanta and Detroit. It is being forecast that the private cop business is set to boom in the coming years as the realities become ever-harsher on America’s streets.

So just keep that in mind today when you’re following the FOMC’s announcements and press conference regarding the future of quantitative easing (most commentators agree that there will be no change in asset purchases for the time being), whatever happens the markets are bound to dance their dance, but it’s also good to receive some feedback from the ground up.